Gas market overview Q1 2024

Europe passes winter period with flying colours

- Price downtrend sustained into Q1 2024

- Historically high storage levels lower demand in the coming summer

- What to expect from Q2 2024

Price downtrend sustained into Q1 2024

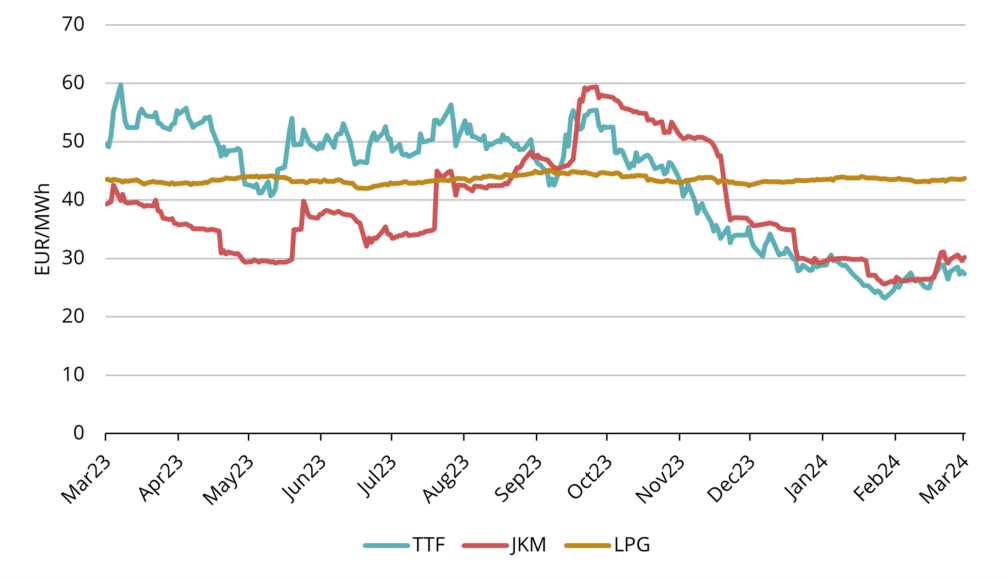

First quarter of the year continued the downtrend which started in October 2023. TTF front-month futures, which are the main contracts for gas prices benchmark in Europe, bottomed at 22,32 EUR/MWh on February 22nd, the lowest level since April 2021. Gas prices were falling during January and February, as the impact of previous quarter geopolitical events waned and mild weather in the NWE region continued. March posted the first monthly gain in gas prices since October, as Europe continued to compete with Asia for LNG supplies and Norway had some issues with production. However, overall Q1 2024 saw smaller volatility compared to the last two years, and the market was quite stable.

During Q1 2024 the average European natural gas benchmark, ICE Endex TTF front-month price was 27,56 EUR/MWh. The ICE TTF forward price for the nearest full month, May 2024, closed at 27,34 EUR/MWh on the 28th of March.

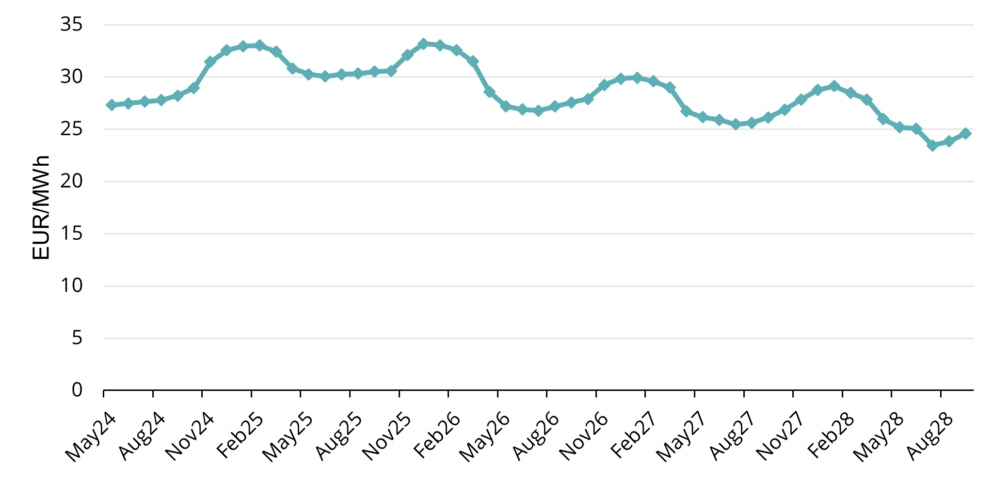

Looking at the forward curve, prices turn into contango, meaning prices in coming months are higher than previous months on the curve until the end of the next winter period (see fig. 2). Calendar year 2025 is being priced around 2 EUR/MWh higher than the remainder of CAL2024.

Historically high storage levels lower demand in the coming summer

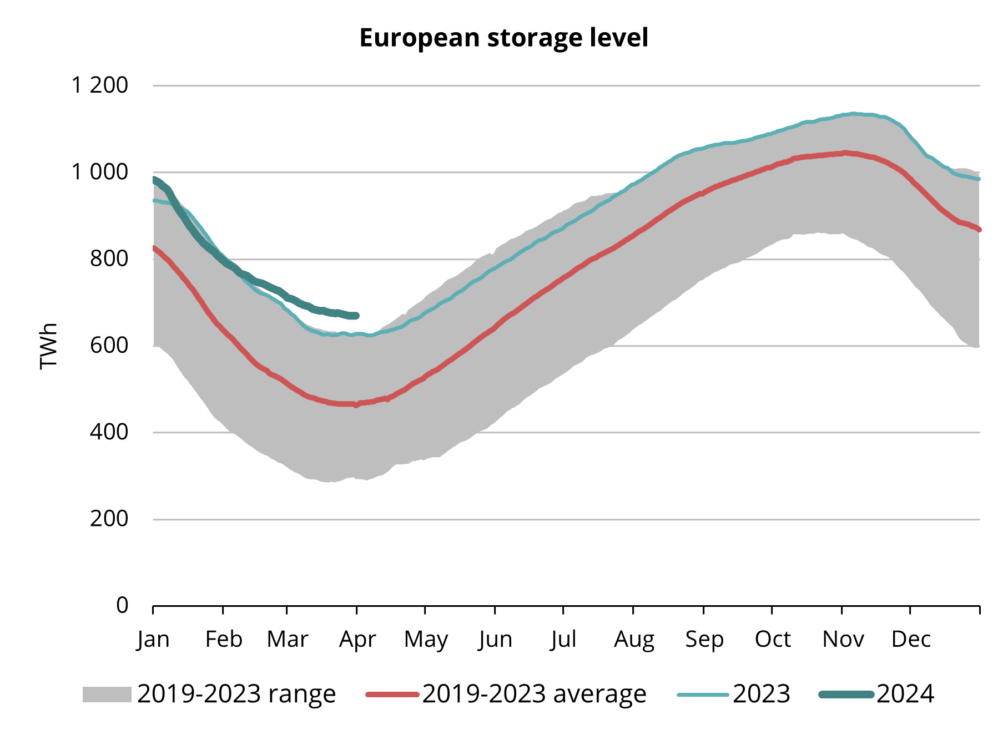

European gas storages have maintained very healthy levels throughout the winter period and Europe is ending the withdrawal period at historically high levels (see fig. 4). It means that going into the injection period less of the storages need to be filled, which indicates lower demand during the summer season in Europe.

In addition to warm weather in Europe (and therefore lower heating demand), another factor that has helped to keep the NWE storage levels higher than historical averages, has been Ukrainian storage sites. More than 160 foreign energy companies from 32 countries have been using Ukraine’s underground sites for gas storage (Argus Media). To mitigate risks, market players accelerated withdrawal from Ukraine’s storages during the first part of the winter, which enabled a slower depletion of NWE storages.

In the last week of March, Ukraine reported damages to gas storage facility after Russian attack but said that there were no critical consequences. Although the attack has not hindered injection capacity at Ukraine storage sites, it has raised concerns that Ukrainian infrastructure is more vulnerable to disruptions. As current summer-winter price spreads are too narrow to cover war risk insurance costs (Argus Media) then Ukraine storage injections will likely be lower relative to last year, reducing the gas demand in Europe during the summer period.

As of 27th of March, TTF winter 2024-2025 period was priced 4.19 EUR/MWh higher than summer 2024. On the same date in 2023 the spread was much wider, 8.10 EUR/MWh (Argus Media). Although lower demand may push first part of the curve (summer months) lower, then compared to last year, a much lower priced front-winter contracts significantly reduce the odds of large seasonal spreads to arise because bigger volatility in percentage terms would be needed to move the spread wider in terms of EUR/MWh. As of comparison, the TTF 2024-25 winter contract averaged around 31 EUR/MWh in March 2024, while the front-winter had averaged over 52 EUR/MWh in March last year (Argus Media).

What to expect from Q2 2024

Due to previously mentioned reasons – historically high storage levels in Europe, increased risks regarding the Ukraine storage sites safety, and quite narrow summer-winter spreads – LNG demand in Europe should be lower compared to last year and keep the summer prices under pressure. However, it is still very important for Europe to have the storages filled to the near maximum level during the summer, and fill some of the Ukrainian storage capacity, as otherwise NW Europe would be more vulnerable to cold spikes in next winter, should the weather turn colder than average (Goldman Sachs).

In our region the pipeline between Finland and Baltics, Balticconnector, should be back online from 22nd of April. As it went offline back in October 2023, Finland became an “energy island” by itself (please see our previous publication for Q4 2023). Credit to all market participants, Finland’s gas market operated without any significant issues throughout the winter and gas supply was secure. When the Balticconnector is back online, the flows between Baltics and Finland can return to normal, allowing to balance the supply-demand much better.

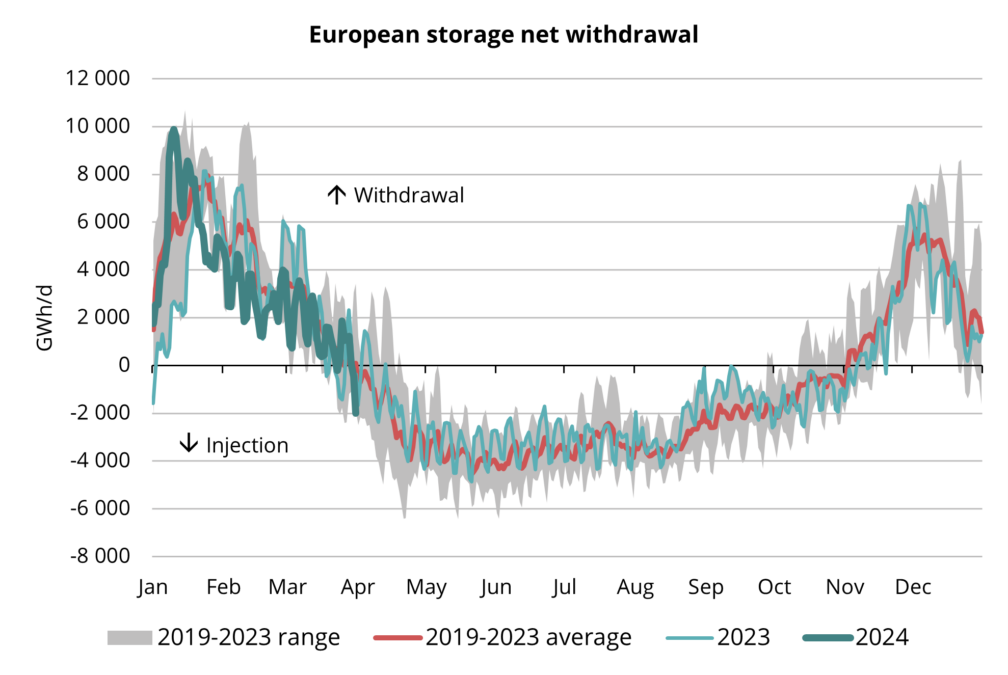

The focus during spring months shifts from withdrawal period to injection season in gas storages (see fig.3). With European storages currently at healthy levels and ample LNG supplies available, this transition is anticipated to proceed smoothly, maintaining muted prices barring any unforeseen shocks to the system. In our home markets, return of the Balticconnector adds stability and security to the gas market.

This market overview is for informational purposes only. We aim to compile the most relevant data from various sources in good faith but the analysis should not be treated as an advice or taken as the sole basis for any action.